Accounting, often referred to as the language of business, is the measurement, processing, and communication of any financial and non-financial information of economic activities, lays the cornerstone for any business. Well-organized bookkeeping can provide you with key figures that help you determine whether the firm is operating healthily and in what aspect the performance can be improved. It also equips you with the documents to be disclosed to external users to understand your business.

1. Why accounting?

Financial accounting is the field of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. This involves the preparation of financial statements available for public use. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes.

It is important that you keep track of the money spent so that you can monitor the growth of your business. Keeping every account organised and all in one place would allow you to access financial transactions easily.

2. Accounting Basics

1.1 The Accounting Principle

ASSETS = LIABILITIES + EQUITY

- Assets: includes both current assets (items that are expected to convert into cash within a year; e.g. cash, cheques, accounts receivable, inventory and prepaid expense) and non-current assets (items which full values would not be recognized until after a year; e.g. land, equipment and machinery)

- Liabilities: similarly, there are current liabilities (short-term debts that are due within a year; accounts payables, notes payable, unearned revenues) and non-current liabilities (long-term debts that are to be repaid after a year or longer). A key differentiation would be the time of the payment vs the time of acquiring the said items.

- Equity: relates to the owners’ withdrawals, owners’ capitals, revenues, expenses

1.2 Double-entry accounting

This essentially means we always have two entries for each transactions

- one for DEBIT one for CREDIT.

When we take out money from our bank account to pay for an expense,

we always CR (-) Savings account (it is a current asset) and DR (+) the expense.

→ there will never be a time where there are two CR and two DR!

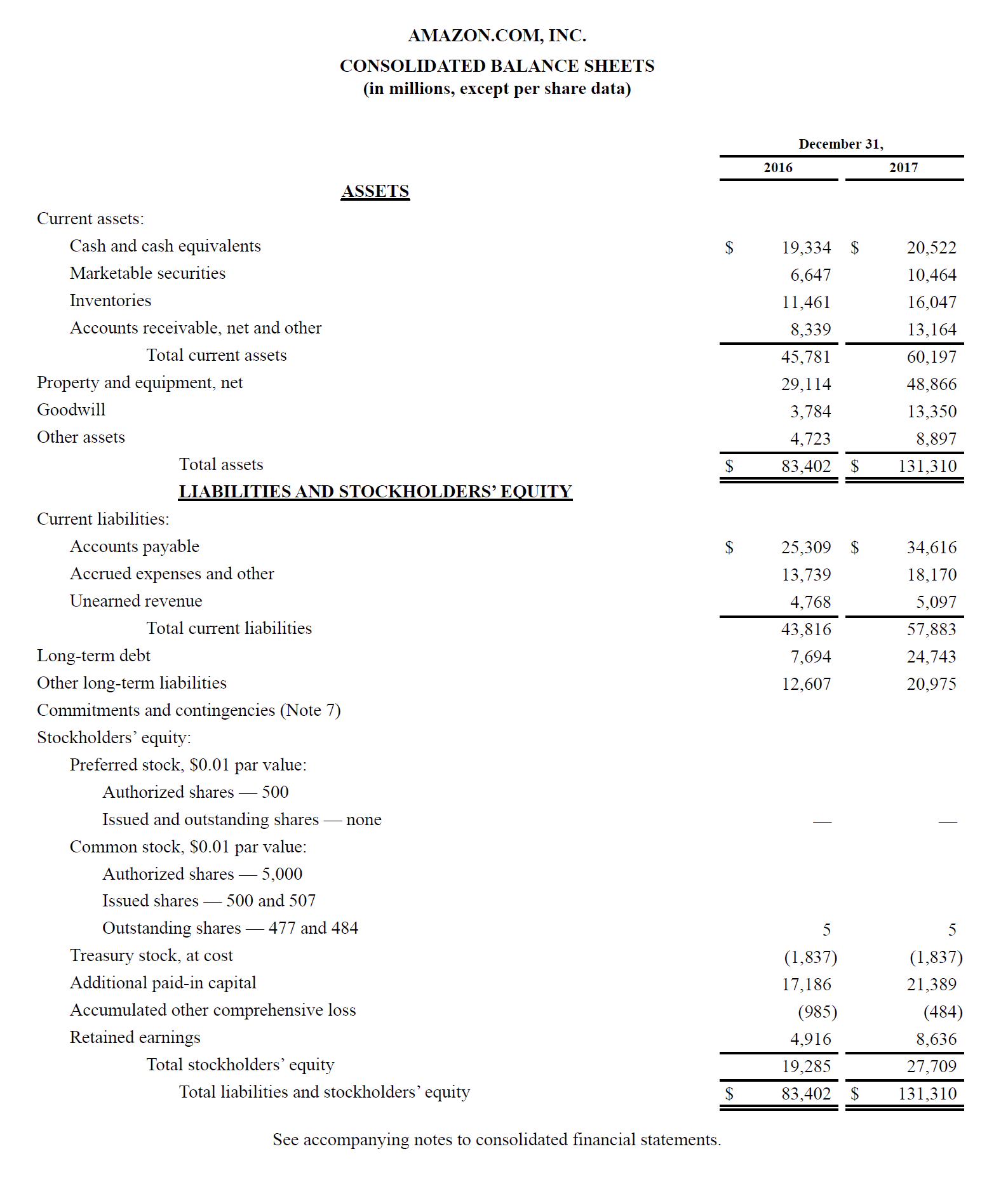

1.3 Understanding the Balance Sheet

- Balance sheet is a financial snapshot at a specific time point, which categorizes and lists out the current balance of each account that belongs to either assets, liabilities, or equity.

Here is an example

- Understanding the items in balance sheetAssets

- Inventories: the merchandise that your business retains for sale

- Accounts receivables: the short-term amount that the clients have not paid for the goods and services a company has provided.

- Property, plant and equipment, net: the fixed assets a company holds. Net means disregarding the depreciation

- Depreciation: any long-term assets wear out during its life span, thus decrease in value over time. Depreciation is used to describe the loss of value of these assets.

- Goodwill: the value of a company that exceeds its market value, usually for its reputation or patronage

- Intangibles: assets like trademarks, patents, etc. are categorized as intangibles.

- Accounts payable: the amounts already incurred but not yet paid, usually to your suppliers, .

- Unearned revenue: the revenue received in advance for goods or services not yet rendered.

- Accrued expense: the expenses incurred but not yet paid.

- Common stock: the total amount of stockholder’s investment into the company

- Retained earnings: total profits or losses since the company’s inception.

Templates

❤️ FSI has prepared for you the essential templates that facilitate your bookkeeping. Click the links below to check them out!

1.4 Understanding the Statement of Income

Additional Readings:

- 12 Reasons to Keep Digital Accounting Records: https://bestchoiceaccountancy.co.uk/reasons-to-keep-digital-accounting-records/

PS!

At FSI we’re always seeking to improve, so if you have any feedback on this guide/template, please do not hesitate to let us know.